A personal loan is cash acquired from a loan specialist that Borrowers can utilize for almost any reason.

They might be using it for taking care of an obligation, supporting an enormous buy like a vehicle or a boat, or taking care of the expense of a high cost like a wedding or getaway.

Loans can be gotten from online moneylenders, nearby banks and loan associations and the assets are given in a precise amount. When you get the money, you should make instalments until the obligation has been completely reimbursed.

One of the most significant advantages of personal loans versus Mastercard is that they accompany a proper financing cost and reimbursement terms. Click to get a personal loan to solve your financial problems.

What Is A Personal Loan?

A personal loan is a cash you get from a bank or other monetary foundation with a set reimbursement period and reliable, regularly scheduled instalments. Most personal advances are unstable, so you will not need to put down security to acquire the cash.

How Does a Personal Loan Function?

If you’re hoping to get a personal loan, the borrower will need to finish an application and hang tight for endorsement. This interaction might take anyplace from a couple of hours or days.

You will likewise begin to reimburse the money immediately. Your bank will probably report your record movement throughout the advance term to the loan departments.

Making on-time installments can assist you with building a positive financial record. The loan specialist like Personal Loan Pro will dispense cash into your ledger whenever you’re endorsed, and you utilize the assets for your common reason.

Here is a clarification of the relative multitude of moving parts that make personal loans what they are:

Financing costs

Personal loans charge borrowers a decent APR, or yearly rate, on top of the advance sum (or head). This APR can change contingent upon reliability, pay and different variables. The personal advance financing cost decides how much interest borrowers pay over the existence of the loan.

Regularly scheduled instalment

Personal loans accompany a proper regularly scheduled instalment that the borrower will make for the existence of the loan, determined by including the head and the interest. You can generally get a lower regularly scheduled instalment if you consent to take care of your loan over a more drawn-out timespan.

Reimbursement timetable

Reimbursement courses of events fluctuate for personal advances. However, shoppers are frequently ready to pick reimbursement courses of events between one and seven years.

Start expenses

A few personal loans charge an underlying beginning expense on top of the first measure of your advance. While start expenses change, it’s not unexpected to see beginning charges as high as 6% of your loan sum.

5 Best Personal Loans in the US for Borrowers

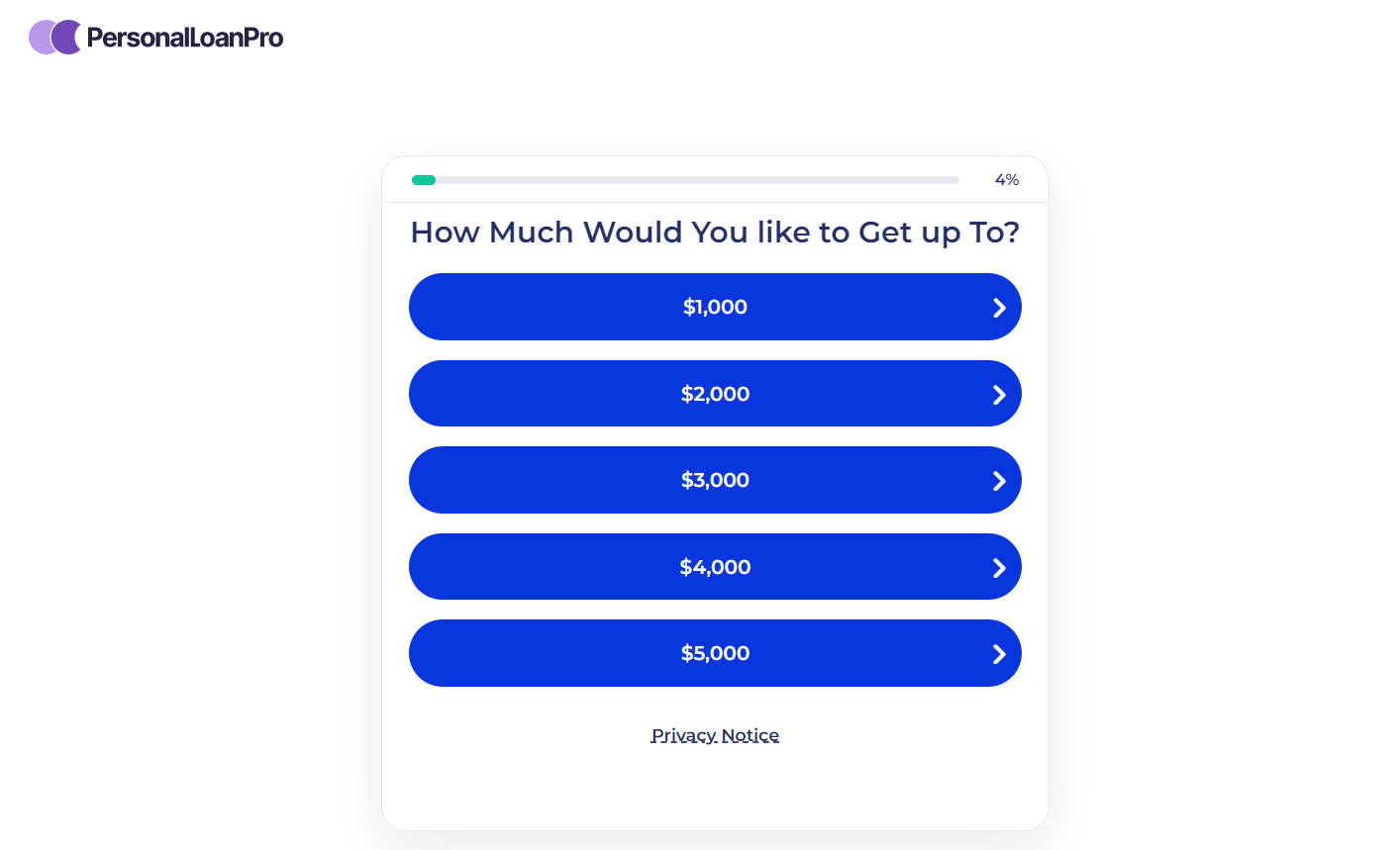

1. PersonalLoanPro.com

It isn’t a bank and doesn’t settle borrowed or loan choices. Personal Loan Pro interfaces intrigued people with a moneylender from its organization of supported loan specialists.

Personal Loan Pro gets remuneration from its moneylenders, frequently founded on a ping-tree model like Google AdWords, where the most noteworthy accessible bidder is associated with the customer.

2.FastTitleLoans.com

A personal loan by fast title loans serves as an installment loan. Borrowers can use it for various personal objectives like medical bills, house rent, car mortgage, etc. Its duration is usually between 12 to 96 months.

3.iPayDayLoans.com

FastPaydayLoans US is the most straightforward payday advance you’re searching for in the US. Since You can finish everything from applications to cash on the web, you can save time visiting advance offices.

You simply need to finish up a structure and hang tight for us to coordinate you with a proper moneylender.

4.WeLoans.com

WeLoans is a broker instead than a direct lender. They don’t lend money but act as an arbitrator connecting you with our extensive panel of direct and reputable US loan lenders and allowing the Borrower to get a short-term loan the same day or the following business day.

5.CocoLoans.com

CocoLoans.com iis a US-based online broker that specializes in assisting people in getting a reasonable loan more conveniently and quickly.

They have partnered with the best lenders in the US and provided all types of loans for clients.

Although they are a relatively new company, they have earned customers’ trust with our user-friendly and intuitive application method and trustworthy lenders who deliver quick loan conclusions.

Top 3 Motivations to Apply for a Personal Loan

Your monetary requirements don’t necessarily seem when you are anticipating them. You might require cash when you are least prepared for it. In the more established days, such occasions implied that the borrower visited the cash bank.

Today, all personal cash prerequisites are met by personal loans. Planned as a fast arrangement, a personal loan requests no guarantee like gems, selling the house, etc. There might be various conditions that lead you to look for a loan. Anything is the need. It is not difficult to get a personal loan. Let us take a gander at the best six justifications for why people like you go for a personal loan.

Obligation combination

Numerous borrowers have a loan issue. The issue isn’t about reimbursement. The problem lies in such a large number of loans. Many loans mean multiple EMIs. To stay away from this, may apply for a personal loan. A personal loan solidifies all the obligations in advance, with a reasonable loan fee and residency. Along these lines, you can avoid the bother of overhauling many loans.

Paying charge card loan

Charge card loans are excessive. This is a reality. It may be for shopping or spending while on an abroad excursion. Reimbursement can be a significant issue if you spend a ton of the Mastercard.

With yearly loan costs of 40%, this is a very costly obligation to convey for a long time. Thus, utilizing a personal loan, which means yearly loan fees of 12-15 per cent, is a much savvier choice.

Can’t ask family members or family for cash

Numerous borrowers come from wealthy families. To them, getting a loan isn’t an issue. The issue concerns the overall difficulty of having taken a loan from a family. A loan taken from kin or a parent can be free. For example, no interest will be charged. In any case, the relationship might become awkward after taking the loan.